Our view on the new SBTi net-zero standard

At Dinamo, we have been closely following the proposal for the new SBTi net-zero standard, currently open for public consultation until June 1—the final day to submit comments. We especially encourage those deeply engaged in this topic—from companies to climate and sustainability professionals—to participate in the survey and help improve a standard that will have a global impact.

The SBTi standard is currently the most internationally recognized framework for defining how companies set, implement, and communicate their climate commitments. This revision presents a key opportunity to redefine the level of corporate climate ambition, aligning it with the demands of a decarbonized economy.

Moreover, this update comes at a particularly relevant time for European companies, who are navigating a changing regulatory environment with the implementation of directives such as the CSRD (sustainability reporting), CSDDD (sustainability due diligence), and the upcoming Green Claims Directive—all of which highlight the need for rigorous and verifiable frameworks like SBTi’s.

We won’t summarize all the proposed changes here—they are numerous and quite technical—but we do want to share what we consider most relevant from our perspective.

What we appreciate

1. A differentiated approach based on company size and geography

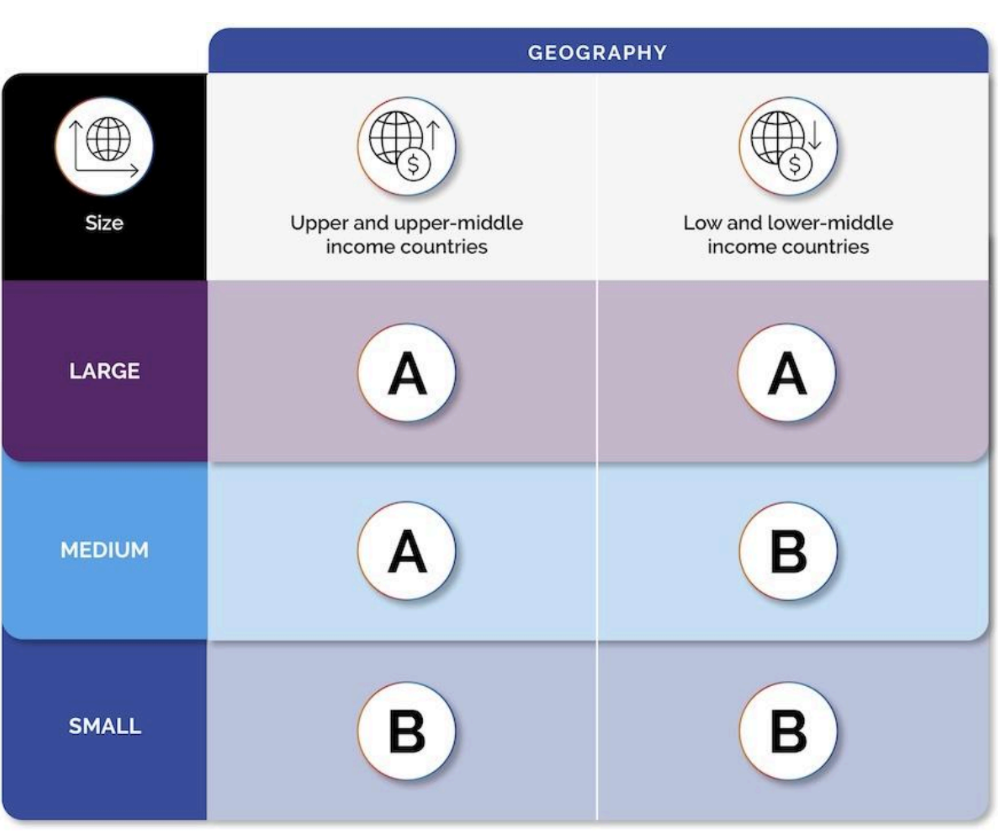

The new standard introduces a distinction between Category A and B companies, based on size (large, medium, small) and whether they operate in high- or low-income countries. This differentiation is key to reflecting local realities. Below we share the matrix that classifies companies into the two categories based on size and geography.

2. A more practical approach to Scope 3

At Dinamo, we support all companies setting long-term targets for Scope 3 emissions reductions. In most cases, these emissions exceed those from fuel or electricity use. In a world moving rapidly toward energy system decarbonization, it’s essential that organizations plan to decarbonize their entire value chain—even if efforts can’t begin immediately.

The new standard requires companies to address all relevant Scope 3 emission sources, defining “relevant” as any source exceeding 5% of the total. This replaces the previous thresholds of 67% (short term) and 90% (long term), and we see this as a very positive change: it enables more granular and practical prioritization and prevents significant sources from being excluded due to arbitrary thresholds.

We particularly appreciate the consideration given to allowing companies to improve data quality and traceability over time, especially for Scope 3. This is a pragmatic yet realistic approach.

3. Introduction of non-emission-based metrics

The new standard requires companies to include indicators such as renewable energy use or the percentage of suppliers with reduction targets. This shift reinforces the move from commitment-based approaches to actual implementation, which aligns well with the real challenges companies face today.

We recommend that any high-emission activity representing more than 5% of Scope 3 should have its own specific target at the activity level, consistent with the overall relevance threshold of the new approach.

4. Possibility of using “activity pool” data

The standard allows companies to demonstrate progress using activity-level aggregated data (e.g., a supplier pool or a local electricity system) when detailed information isn’t available. This pragmatic measure, called “indirect mitigation,” can help unlock ambition in Scope 3 efforts.

We support the use of indirect mitigation, provided that:

- It is used as a transitional measure when direct mitigation isn’t possible,

- It yields measurable, comparable results, and

- It is reported separately from direct mitigation.

5. Climate transition plan as a mandatory requirement

We welcome the requirement for companies to have a climate transition plan. This measure strengthens the focus on actual implementation and public accountability and aligns with new regulations like the CS3D in Europe.

6. Greater rigor in traceability and claims

The standard improves methodological consistency (base year, 1.5°C alignment, etc.) and introduces a dedicated section on corporate climate claims. This aligns with frameworks like the Consumer Empowerment Directive and anticipates the upcoming Green Claims Directive.

What we think needs further exploration

1. The real capacity of medium-sized companies

Although the new standard is more technical and demanding—which is positive in terms of ambition—it also imposes a significant burden in terms of resources and expertise. We doubt that many medium-sized companies in high-income countries, currently classified as Category A, will be able to comply without additional technical support. In line with competitiveness and a just transition, we recommend reclassifying this group as Category B.

2. “Residual” and “ongoing” emissions: more clarity and incentives needed

We appreciate the new definitions of “residual” (irreducible) and “ongoing” (emitted before reaching net-zero) emissions, which have caused confusion in the past.

Our recommendations on residual emissions:

- Require that residual emissions be neutralized from the year of commitment, not just from the net-zero year.

- Introduce guidance on using a “science-based” carbon price to ensure a fair allocation of the residual emissions budget.

- Adopt a gradual transition approach for “removals,” progressively increasing the share of long-duration removals in line with 1.5°C pathways.

- We also support allowing residual emissions to be neutralized by value chain partners (e.g., suppliers) to avoid double counting.

Our recommendations on ongoing emissions:

- We agree that climate investments outside the value chain to neutralize ongoing emissions (BCVM) should not count as reductions, but they should be incentivized in more ambitious and innovative ways.

- The proposed claim — “Company A has been found conformant with SBTi standard and contributed $1 million to climate projects beyond its value chain, supporting global decarbonization efforts” — feels uninspiring. We recommend allowing companies to communicate the climate impact of these investments, e.g., in tCO₂e avoided or as a percentage of the company’s footprint.

- We also recommend that companies should not receive recognition for reducing ongoing emissions if they only have targets for Scopes 1 and 2; they should first set robust Scope 3 targets.

3. Progress reporting: end-of-period reporting isn’t enough

Currently, the new version of the standard only requires reporting on progress at the end of the target period. We believe this is insufficient. We propose establishing interim milestones to strengthen accountability, especially toward investors and stakeholders.

4. External verification: also for “removals”

The requirement for external verification of emissions inventories is logical and consistent with the evolving regulatory landscape (such as the Green Claims Directive). However, if removals-based claims are allowed, these too should be externally verified to prevent malpractice or greenwashing.